The heated debate on hydrogen in our cities

Hydrogen is often presented as a quick fix to get rid of fossil fuels from heating and cooling in cities. But is it really?

In last week’s Decarb City Pipes 2050 webinar, Lisa Fischer, Programme Leader atE3G discussed with cities the role that hydrogen can play in the decarbonisation of cities. Hydrogen* is often presented as a quick fix to get rid of fossil fuels for heating and cooling in cities. But it is widely debated by experts and has some uncertainties and risks of lock-in effects. We will therefore question this statement point by point.

Is hydrogen efficient?

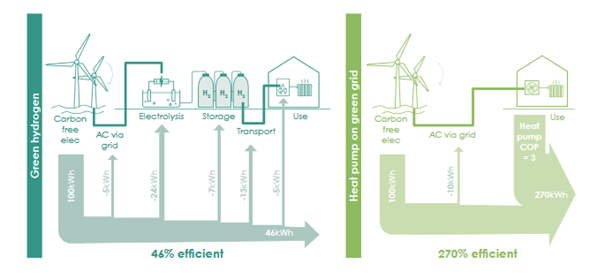

Green hydrogen requires five times more electricity to heat a home than a heat pump. In other words, hydrogen-based low-temperature heating systems consume 500 to 600% more renewable energy than heat pumps. Indeed, the transport, storage, multiple stages transformation and combustion of hydrogen lead to multiple losses.

Richard Lowes from the University of Exeter, concludes: “In every bit of analysis I’ve seen, whether it’s hydrogen or electrification, you have to do efficiency to make things cost-effective.”

Source: LETI hydrogen Report, Data source: Prof David Cebon.

Is hydrogen cost-competitive?

The cost competitiveness is relative and data must be compared with the different low carbon alternatives to heat cities: heat pumps, district heating, and hydrogen boilers. The cost analysis differs greatly according to the criteria used: considering the evolution of hydrogen and electricity prices, estimated temperatures in a few decades, infrastructure, etc.

Scientific studies conclude that hydrogen is not competitive in heating as air-source heat pumps are at least 50% lower cost than the hydrogen-only technologies. The ICCT even concludes that “if natural gas costs were 50% lower or renewable electricity prices were 50% higher in 2050 compared to our central assumptions, heat pumps would still be more cost-effective than hydrogen boilers or fuel cells” which is very interesting news considering the social aspects of the energy transition.

Indeed, as we saw earlier hydrogen-based heating technologies need much more energy than heat pumps and a major part of the price of green hydrogen is the price of electricity. So, when the price of renewable electricity drops, it will be a saving for both hydrogen and electricity which will always be cheaper.

Moreover, some experts predict that if hydrogen is used massively for heating it will double hydrogen costs. A shortage of hydrogen would induce competition between different sectors (industry, chemicals, storage) which will push up the prices.

Nevertheless, unrenovated buildings are the notable exception where hydrogen may be more competitive. But the proposed Renovation Wave will reduce energy consumption for heat and the proposed Minimum Energy Performance Requirements under the Energy Performance of Buildings Directive (EPBD) would tackle these least-efficient buildings first and erase that potential market.

What infrastructure for the use of hydrogen in the city?

Hydrogen has different properties than natural gas. Using 100% hydrogen for heating houses involves some changes in the network to bring gas into the houses and in the house’s appliance itself. There are a number of different materials used for domestic natural gas pipework. Consequently, in some houses, the changeover to hydrogen can be quick with only the change of boiler and meter, but in others, it also requires the whole appliance to be replaced. To facilitate this conversion work, which could take several days per house, the gas companies are proposing to install already mixed boilers ready for future hydrogen use.

Research has shown that many uncertainties remain to be resolved and that beyond the acceptability of hydrogen by owners, “the inaccessibility of domestic gas pipework could be a significant barrier to conversion if pipework needs to be either fully inspected or replaced as natural gas pipes are sometimes covered by concrete or ducted through inaccessible voids”.

Another limitation is the question of who bears the responsibility and the cost of these transformations. Compared to electrification or natural gas, investments in hydrogen will be riskier and will generate fewer capital returns given the unproven technology, uncertainties on hydrogen cost and up-scaling needed. As a result, more public and taxpayer investments should be made to finance construction work.

Is the use of hydrogen rather easy or disruptive for citizens?

This is an important question, very linked to the infrastructure debate, raised by the gas companies. According to them, hydrogen is a “like-for-like” solution: replacing natural gas with hydrogen is a painless and effortless solution for citizens. This non-disruptive argument is very attractive to policy-makers. Nevertheless, it is a bit vague because the change of gas could lead to a change in the bill as well as a replacement of the infrastructure at the inhabitant’s home (boiler, in-house pipelines, cooking stoves) and in his street (pipelines and compressors).

When will the hydrogen technology be ready to heat cities?

Analysing the UK projects and market, Centrica, the biggest gas supplier, admits that it will take more than ten years to produce green hydrogen for heating. While district heat and heat pump technologies are already available. Waiting for the hydrogen era to arrive for cities could create a terrible lock-in effect for the decarbonisation of heating.

Regarding the timeline, Jan Rosenow, from the Regulatory Assistance Project, says “Yes, do some research on hydrogen and do pilot projects, but it is a big bet to say hydrogen will solve our problems in 2040 and then not do anything in the meantime. I think that would be irresponsible.”